If you’ve decided to take the leap and move to Canada, here is how you can save money as a Nigerian immigrant.

There are many reasons why you might decide to move to Canada. The first thing is how good the quality of life in Canada is, which is getting expensive by the day. As you embrace your new life as a Nigerian Immigrant in Canada, you may be especially eager to start strong, feel financially secure, and be on the right track. So, how can you save money as a Nigerian Immigrant in Canada?

Budget, budget, and budget:

One of the hardest things about moving as a Nigerian immigrant in Canada, are the bills you’ve to pay for. But you can’t go wrong with a budget. Creating a budget is a way you can take control of your finances because it lets you know how much you’ll spend in a month, monitor what comes in and out of your account, and get a grip on your spending habits. To start tracking your spending, have your to-do list, estimate what your expenses are in a month, like electricity, and rent, internet bill, how much they will cost. When you know areas where to cut back, allows you to put money toward your savings goals.

Thrift everything if you can:

As a Nigerian immigrant in Canada, especially if you’re a newcomer, it often makes more financial sense to thrift rather than buy brand-name items. Being frugal doesn’t mean you’ve to pinch every penny. Rather it means not frittering away your money on unnecessary purchases, but spending on only things that matter. With thrifting, you’ll get things you want at a good rate that also gives you value for your money. There are many ways to do things; like taking advantage of newcomer offers and shopping during sales holidays and clearance events. Or keep an eye out for promotions, loyalty programs, and discounts.

Take advantage of credit card cashback:

There are Canadian banks that offer up to 4% cashback on purchases when you use your credit card. Shop at stores tied to those credit cards or banks so your purchases qualify for cash-back. Use all the perks that come with your credit card, for instance, free rental car insurance or discounts on flights and hotels. And remember to pay your credit card bill on time to avoid interest charges as those can hurt your financial goals in the long run.

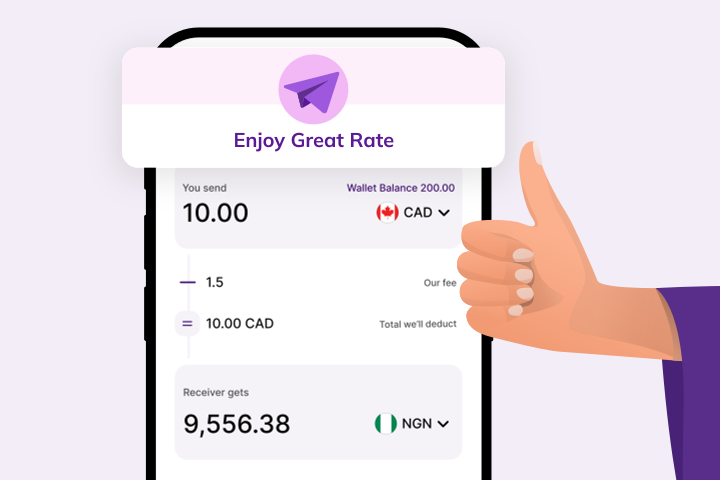

Go for cheap options when sending money home:

Sending money home can potentially put a dent in your pocket, but it’s a thoughtful way to be financially present, stay connected with your loved ones, and show you care about them. When sending money home, it’ll do you good to go for cheap options that won’t stretch you financially and help you save money as a Nigerian immigrant in Canada.

You can use CadRemit to send them money, whether you’re looking to send money for emergencies or celebrate a milestone. The best part is there are no undisclosed hidden fees, and the exchange rates are low and a great value for your money.

Hopefully, these tips help you save money as a Nigerian immigrant in Canada and make your move to Canada feel a little easier both on you and your wallet.