Here are some common mistakes you should avoid when sending money to Canada

When sending money abroad, there are common mistakes to avoid. Sending money to Canada is no different and can sometimes be tricky. Most people overlook important parts like exchange rates, fees, possible errors in recipient details, transfer speeds, and regulations. However, knowing how the mistakes to avoid can help you send money to Canada easily.

Common Mistakes To Avoid When Sending Money To Canada

Below are some of the common mistakes you can make when sending money abroad to Canada.

Overlooking exchange rates

One of the biggest mistakes when sending money from Nigeria to Canada is ignoring the exchange rates and fees. Exchange rate fluctuations can affect how much money your recipient receives. A favourable rate means you can send more money, while an unfavourable one cuts the amount they get. To avoid surprises, it’s important to use platforms with the best rates to send money.

With CadRemit, you never have to worry about sending money to Canada with not-so great rates, they’re affordable when compared to other platforms.

Hidden fees

Many money transfer services often charge hidden fees that affect your transactions. These fees include service charges, conversion fees, or additional banking costs. And these hidden fees that can quickly add overtime. So, research these fees and rates before you decide to use them.

There are platforms like CadRemit that allows you to send money to Canada with no hidden fees, what you see is what you get.

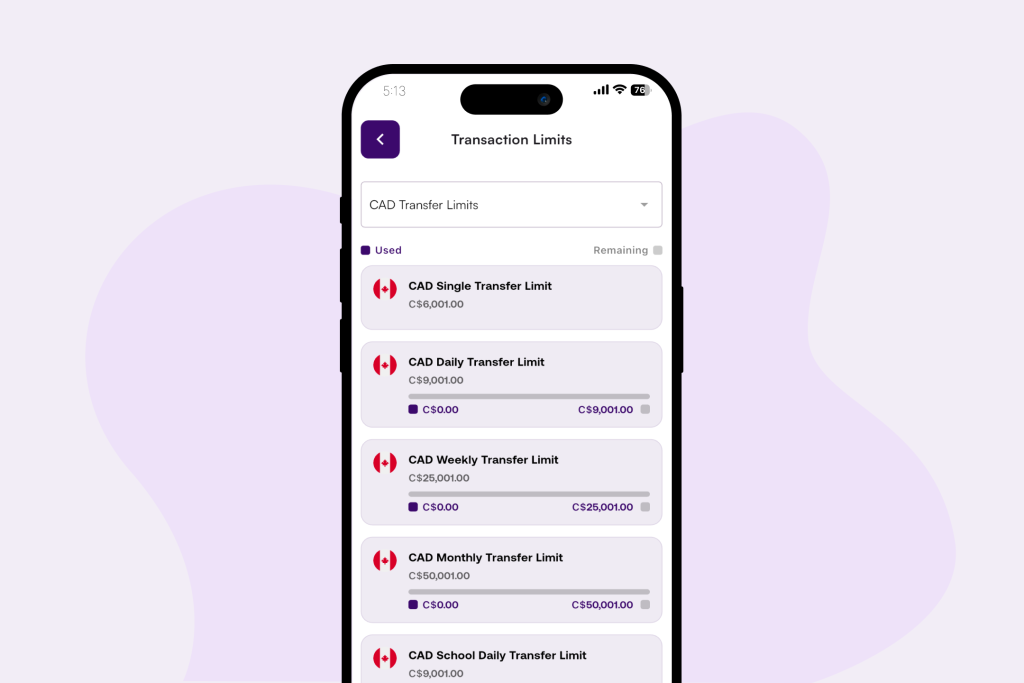

Ignoring transfer limits and regulations

Another common mistake is ignoring the transfer limits and regulations. Both Nigeria and Canada have their own rules regarding how much money you can send abroad. Transfer caps can vary depending on the service you’ve chosen and the regulatory framework in each country. Ignoring these limits may cause delays or even cancellation of your transaction.

Consider the following steps before using a transfer limit:

- Check the maximum amount you can send in a single transaction

- Make sure your transfer method complies with local monetary regulations

- Stay up-to-date about any changes in these regulations

By keeping transfer limits and regulations in mind, you can ensure that your money gets to Canada without unnecessary interruptions or complications. Doing your homework helps you avoid surprises and makes the transfer process easier.

Failing to double-check recipient details

One of the simplest yet most impactful mistakes is failing to double-check recipient details before sending money. Errors like this can lead to unnecessary delays or even you losing your money. These errors usually disrupt the transfer process and potentially result in additional fees to correct.

To avoid these issues, always double-check if your recipient’s details are accurate. And if you’re unsure about any details,go back and check in with the recipient.

Consider making a checklist when gathering recipient information:

- Verify the recipient’s full name and spelling.

- Confirm the correct account and routing numbers.

- Make sure the address matches the recipient’s registered location.

By taking the time to double-check recipient details, you can reduce mistakes when sending money from Nigeria to Canada.

Choosing the wrong transfer method

Selecting the right transfer method is important if you’re looking to send money abroad easily and save money while at it. However, each method has its own set of advantages and disadvantages, such as speed and convenience. Choosing the wrong one can lead to delays or added expenses that could easily be avoided with a bit of research.Comparing different transfer options can help you decide the best method for your needs. Consider the following when choosing from your options:

- How quickly does the recipient need the money?

- Are there any additional fees with this method?

- Can the recipient easily access the money once received?

At CadRemit, we allow the direct transfer that most commercial banks use and the Interac e-transfer which is instant and can send money using only an email address.

Neglecting security measures

Staying security conscious is a smart way to deal with global payments. CadRemit leverages technology to help you protect your money like the 2FA setup on the app. You will need a password, fingerprint, or Face ID to access the app. Additionally, CadRemit is a registered company with operating license to engage in money transfers in Canada, United States and Nigeria. This gives further credence to the platform and why it’s a trusted for international money transfers.

Tips For Sending Money Correctly To Canada

Select a reliable money transfer provider

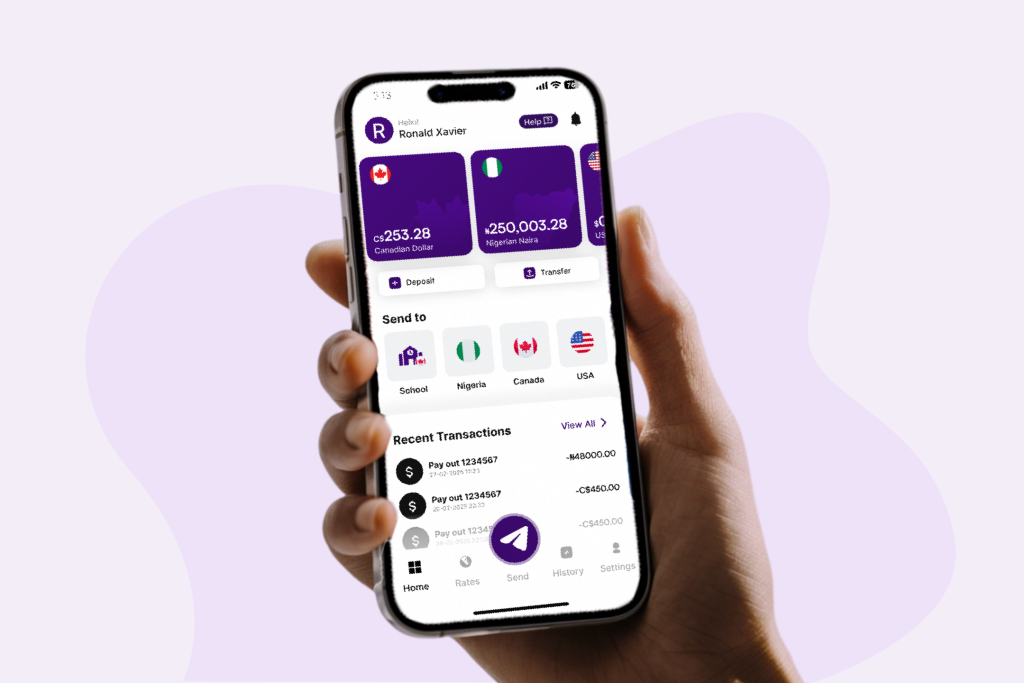

If you decide to send money abroad, choose a reliable and instant money transfer platform. With CadRemit, you can easily send and receive money from Canada to the United States and Nigeria at the best rates.

Consider transfer limits

Most money transfer services have limits to how much you can deposit or transfer in a single transaction or day. With CadRemit, you get a reasonable limit deposits.

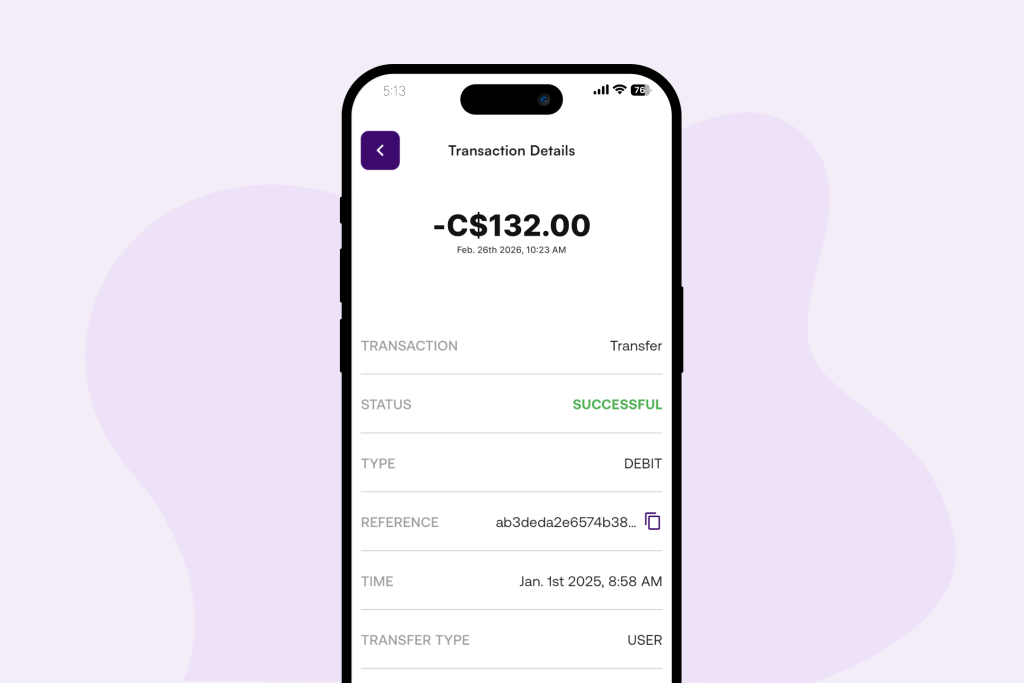

Tracking your transactions

CadRemit also allows you to track your transaction status via our apps. This allows you to know the status of your transaction if it has been received or not.

Be mindful of regulations

The regulations in your country and Canada play a role in international transactions, and knowing them keeps you safe. CadRemit is licensed by FINTRAC for remittance in and out of Canada.

How To Send Money To Canada Instantly using CadRemit

If you are looking to send money to Canada any time soon, consider using CadRemit. Using CadRemit allows you to avoid these common mistakes that’ll save you time and money. The money will get to your recipient instantly and without any delays. Simply download the app and start receiving and sending money now from and to Canada, Nigeria, and the United States.