Here’s what conversion losses are, why they happen, and how to keep more of your money.

There are many parts to relocating to another country, and one hidden cost that’s often easily overlooked is currency conversion losses. These small, almost invisible deductions can eat into your savings and make budgeting in a new country harder than expected.

Let’s break down what conversion losses really are, why they happen, and how you can protect your money when sending or receiving funds.

What are conversion losses?

Conversion loss happens when you lose money during currency exchange due to either:

- Unfavorable exchange rates: This happens when the rate between the bank or the platform you’re using is lower than the actual market rate.

- Hidden fees or markups: It could be small percentage charges that add to your transaction without being clearly shown upfront.

For instance, imagine you’re moving from Nigeria to the UK and need to send ₦1,000,000 to pay for your tuition. If your bank offers an exchange rate of £1 = ₦1,850 while the real market rate is ₦1,900, you’re already losing money before transaction fees even apply. Plus, if there’s a hidden fee on top, your total loss becomes even higher.

Why conversion losses are a big deal when you relocate.

Relocating means you’re stretched financially. That’s exactly where conversion losses hurt the most. A few percentage points might not seem like much at first, but over time, they can become a significant dent in your budget.

- Your budget gets tighter: Every bit you lose to poor exchange rates affects how much you can actually spend abroad.

- Costs are front-loaded: The first few months of relocation come with heavy expenses like rent deposits, furniture, and paperwork.

- Exchange rates fluctuate daily: The value of currencies can shift dramatically in short periods, which can affect your money when converting.

Common mistakes you might be making.

When relocating, people typically use one or more of the following options to move money between countries, and that’s where conversion losses tend to happen.

1. Traditional banks.

Banks might be your first choice because they feel safer and more familiar. It’s easy to accept their rates without comparing them to the real market rates. However, banks typically offer lower exchange rates and charge higher service fees than independent money transfer services. The convenience they provide often comes at the expense of value, and while their rates might look appealing at first glance, they usually include hidden margins or extra fees that reduce what you actually get.

2. Currency exchange bureaus.

These offer better rates than banks, but it only depends on timing and location. In busy areas like airports, for example, rates can be significantly worse with high commission fees. They often add a markup to the official rate, meaning you’ll get less value for your money and end up paying more. Plus, cash-based exchanges are less secure.

3. Peer-to-peer or informal channels.

It’s convenient to want to turn to acquaintances or social groups to exchange money informally, but this can be risky. You might get a slightly better rate, but you’ll also risk being scammed, delayed, or probably get no fraud protection for your transactions.

4. Online money transfer platforms.

Many digital platforms advertise low fees or no-fee transfers, but they often add hidden markups in their exchange rates. Always check what the real mid-market rate is before you make a transaction.

How CadRemit helps you with conversion losses.

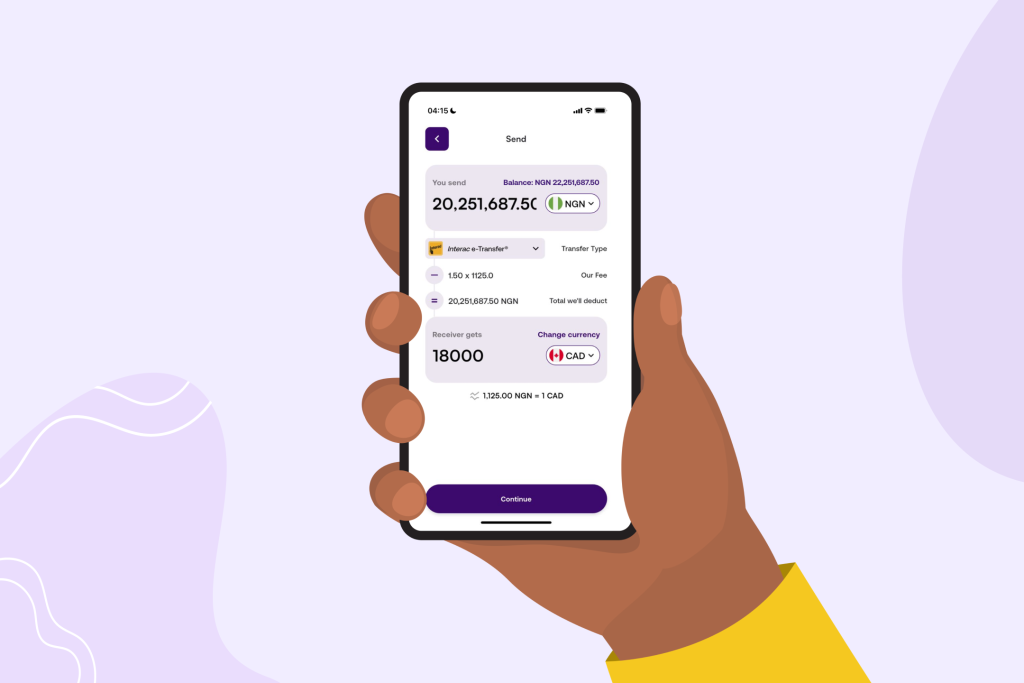

1. Transparent exchange rates.

Find real-time, transparent exchange rates that stay closely aligned with market rates. You always know exactly what you’re getting before confirming any transaction with no hidden charges, no confusing markups, just clear and honest rates every time. This way, whether you’re sending money to family, paying for something abroad, or receiving freelance payments, you can be sure you’re getting the true value of your money without any unexpected deductions

2. Multi-currency accounts.

With CadRemit, you can hold and manage multiple currencies: Naira, USD, CAD, and EU all in one place.

So if you relocate to Canada, the UK, or the USA, you can receive payments in your new country’s currency and decide when to convert, based on the most favorable rates. This will help you avoid unnecessary losses from poor timing or fluctuating rates and let you hold and spend different currencies without converting immediately.

3. Low, clear fees.

CadRemit believes in clarity and fairness. The fees you see are the only fees you pay. Whether you’re sending funds home to support your family or transferring money for personal expenses, CadRemit keeps it straightforward so you can plan better.

4. Fast and reliable transfers.

Using CadRemit means your transfers are quick and secure. You won’t have to wait days wondering for your money to arrive or lose more money to delays or reversals.

5. Perfect for freelancers.

If you’re a freelancer, you’ll probably receive international payments from platforms like Fiverr, Upwork, or direct clients in USD or EUR. Instead of losing money through multiple conversions from client to payment platforms.

How to beat conversion losses.

Here are ways to minimise conversion losses and keep more of your money when relocating abroad.

1. Compare rates before every transfer.

Exchange rates fluctuate throughout the day. Before you make a transfer, compare rates across different services. Websites and apps that show the mid-market rate—the actual rate banks use when trading currencies can help you spot inflated rates.

2. Time your conversions wisely.

If your relocation allows for flexibility, pay attention to rate trends. Global currencies can strengthen or weaken based on news, politics, or economic shifts. By converting when your home currency is stronger, you’ll get better value abroad.

3. Transfer larger amounts less frequently.

Most transfer services charge a fixed fee per transaction, so sending smaller amounts multiple times can add up. Instead, send more if it’s possible, so you might save on cumulative fees.

4. Avoid double conversions.

Sending money through platforms that automatically convert multiple times means you’re losing value at each point.

5. Keep an eye on exchange rate alerts.

There are some platforms that allow you to set alerts for when exchange rates are low. This way, you can plan large transfers when rates are most favorable.

When you lose money to poor exchange rates or hidden fees, it’s not just a few extra charges, but it’s you’re losing value for your hard-earned money. Understanding how conversion losses work and learning how to minimise them can help you manage and plan your finances better.