How diaspora funds are transforming lives, and why the system still needs fixing

Fatima is a nurse living in Montreal. Every month, like clockwork, she sends money back home to Nigeria. It covers her younger brother’s school fees and helps her parents keep food on the table. For Fatima, these transfers are more than numbers; they’re a lifeline, a promise, and a connection.

If you’ve had to send money home, you know exactly what this feels like.

Africa’s economic engine is gaining momentum in 2025, despite global headwinds. From inflation to geopolitical unrest, the continent is still projected to grow 3.9% this year, possibly rising to 4% in 2026. Part of the driver? You, the diaspora.

Today, remittances are one of the quiet forces making it all work. Let’s unpack how it’s happening, who’s sending what, and what’s holding it back.

The Economic Lifeline From The Diaspora

Remittances today are about more than family support in 2025. They’re financial shock absorbers. When jobs are scarce or currencies collapse, it’s these flows from abroad that help keep lights on and dreams alive.

According to the African Development Bank, remittance inflows across Africa could hit $500 billion by 2035 if we can bring down the transaction costs.

Even at this current state, the numbers are huge:

- In 2024, Egypt pulled in $22.7 billion.

- Nigeria followed with $19.8 billion.

- Morocco saw $12.05 billion.

- Even Zimbabwe, despite economic turbulence, received $3.08 billion—enough to keep many families afloat.

In Senegal, remittances make up 11% of GDP. In Kenya, inflows jumped 18% in a year. As you can see, these aren’t fringe funds, but are central to economic growth.

Through it all, remittances stay steady and can even rise in tough times. That reliability is something that helps, and an investment that often can’t be matched.

A Snapshot Of Remittance In 2025: Who’s Sending What

Let’s break this down for you with a few stories.

In Nigeria, government reforms and talks of launching a diaspora bond are stirring excitement. The goal? $1B in monthly remittance inflows.

In Kenya, where overseas work is being actively promoted, most funds now come from the U.S., with $4.94 billion coming in last year, and rising.

In Morocco, remittances help pay for everything from healthcare to small business investments, and across the DR Congo, even though formal remittance figures are shrinking, families still rely on them in conflict-affected areas. That’s the quiet power of the diaspora capital.

Yet what’s reported is only part of the story. Informal transfers, such as cash handed to a traveler or sent through unlicensed agents, are massive. In some regions, they might even surpass formal figures.

The Big Barriers Still In The Way

1. Fees that hurt.

Despite their importance, remittances to Africa remain costly and inefficient for many senders and recipients. Sending $200 to Africa can cost up to $16 using some remittance channels.

Now compare that 8% to the UN target of 3%. Why so high? Lack of competition, red tape, and tech systems that don’t talk to each other. Plus, a lot of people still depend on cash, not mobile wallets.

2. Informal channels dominate in underserved regions.

In many rural areas, there’s no reliable banking infrastructure. So people turn to informal channels. They’re faster, maybe, but they’re risky, untraceable, and unregulated. This deprives national economies of formal foreign exchange and makes it hard to plan or regulate remittance flows. Governments and fintech startups are racing to solve this challenge through mobile money platforms, digital wallets, and cross-border APIs.

3. Exchange rate gaps.

In several African countries, exchange rate policy has a direct effect on remittance behaviour. In Nigeria, for instance, wide gaps between the official and parallel market currency exchange rates push people toward informal transfers. If a dollar gets you more naira access on the black market, formal banking channels become less attractive.

4. Financial inclusion is still catching up.

Many Africans still lack access to the financial system. In countries where banking is limited or mistrusted, digital platforms can bridge the gap. This happens if users have smartphones, mobile network coverage, and basic financial literacy. Until infrastructure catches up, remittance innovation will be limited to urban or semi-urban populations.

5. Missed opportunities for investment.

Most remittances are spent on essentials, which makes sense. But imagine if even 10% could be pooled into local businesses, real estate, or diaspora bonds.

In 2025, some countries are taking steps. Senegal’s diaspora investment bank aims to channel funds into agriculture and tourism. Nigeria’s proposed diaspora bond could allow Africans abroad to invest directly in national infrastructure. These innovations need scaling and cross-border policy harmonisation to flourish.

How CadRemit Is Changing The Game

Africa’s remittance revolution is due to the massive innovation in the sector. Moreover, CadRemit is leading in the development of purpose-built technology.

For decades, the continent has moved from traditional banking models in favour of mobile-first financial tools. Now, with widespread smartphone adoption and improved internet access, platforms like CadRemit can deliver financial services where traditional banks cannot.

Global Instant Transfers and Affordable Fees.

If you’ve ever worried about fees, speed, or whether your money would even arrive, CadRemit gets it. We’ve been there, and that’s why we built a better way.

CadRemit is fast, transparent, and built for real life.

- No hidden charges. You see the rate, you know the fee.

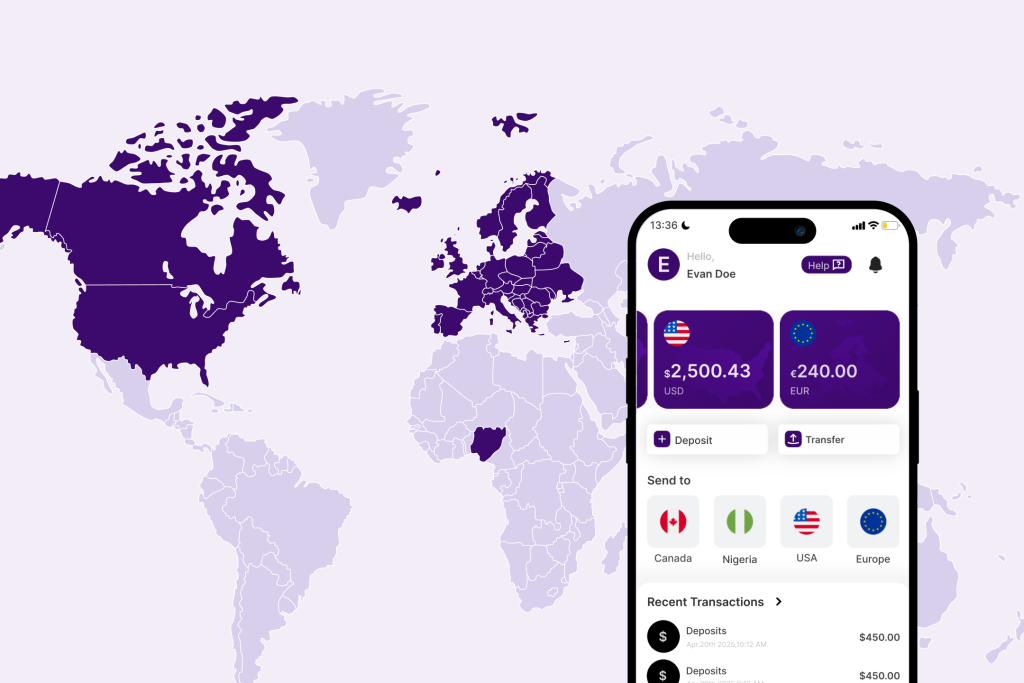

- You can send to Nigeria, Canada, the U.S., and Europe.

- You can pay tuition in Canada, fund your wallet, and even buy groceries.

In just 9 months, CadRemit has grown from a modest base of 20 users to a thriving community of over 10,000 customers, processing more than 100,000 transactions across Nigeria, Europe, the United States, and Canada. This kind of growth speaks volumes about CadRemit, not just filling a gap, but becoming a preferred solution.

At the heart of CadRemit’s model is its transparency. Users always know the exchange rates and fees before they send. There are no hidden charges and no last-minute surprises. This transparency builds trust, which is important in a space where many people rely on informal or risky methods due to a lack of alternatives.

Innovation And Technology In African Remittances.

With Africa’s mobile money penetration now covering over 60% of the adult population in key markets, wallets are becoming the new bank account. CadRemit fits into this system perfectly, since all you need is a phone.

With CadRemit, you get virtual wallets to send, receive, and convert between CAD, USD, EUR, and Naira. If you’re paying tuition in Canada, our support team is on standby 24/7 to assist you all the way.

Additionally, there is also a CMT points system that rewards loyal users. CadRemit has also integrated a push-to-card solution that allows users to send money to virtual cards from their wallets. This is a leading innovation, and one to be celebrated across the continent.

For now, CadRemit’s success still lies in keeping things simple. Unlike other fintechs built for digital elites, CadRemit is built for everyone. Whether you’re an uncle in Canada or a grandma in Edo State

Financial Education, Regulation, and Regional Partnerships.

Technology can only go so far without enabling ecosystems behind it. That’s why the future of remittances must also involve financial education, smarter regulation, and stronger partnerships between African countries.

CadRemit recognises that sending money is just one part of the story. Knowing how to use that money is equally important. Through its customer engagement strategies, the platform encourages better financial literacy among users. From understanding exchange rates to budgeting transfers, users are empowered to make informed financial decisions.

On a regulatory level, CadRemit is compliant to offer Naira, CAD, EUR, and USD remittance, setting a standard for cross-border operators. In a space often clouded by informal and unlicensed actors, this legitimacy helps build confidence among users and regulators alike.

What’s also critical is interoperability. The African remittance space is still fragmented. To fix this, platforms must work together and not compete in silos. CadRemit is actively seeking partnerships that can extend its reach to other corridors, making it easier for people to send money across multiple African countries, not just Nigeria.

At the end of the day, the money you send tells a story of sacrifice, support, and love. For too long, the system made that harder than it needed to be, but not anymore. And CadRemit is proof that global remittances can be easy, supportive, and smart. That your money can move as fast as you want. Whether you’re sending money for school fees, groceries, or just showing care, CadRemit is making sure it happens with no queues, guesswork, but just peace of mind.