Everything You Need to Know About the CadRemit App for International Money Transfers

In a world where migration, remote work, and global education are on the rise, money shouldn’t have borders. That’s where the CadRemit app comes in, a cross-border platform for Nigerians at home and abroad, diasporans living in Canada, Europe, or the USA, to send money to their loved ones. But it started as a solution to help Nigerian students pay Canadian tuition payments, then evolved to be more, to help users send and receive money faster, smarter, and cheaper because of how slow and expensive remittance can be. That’s the gap CadRemit was built to fill.

CadRemit’s mission is to empower Nigerians both in the diaspora and at home with quicker, safer, and more affordable ways to move money across borders. Whether you’re paying tuition in Canada, receiving freelance payments, or supporting family.

But what makes CadRemit stand out?

Built for the Diaspora Life: A Remittance App That Understands You

CadRemit isn’t trying to be everything for everyone; it’s focused on solving real problems for Nigerians living abroad and those sending money back home. Whether you’re:

- A student in Canada who wants to pay tuition.

- A freelancer getting paid in USD or Euros.

- A business owner with a remote team.

- Or a parent in sending money for Upkeep abroad.

Whatever the reason may be to send or receive money, the CadRemit app is built to support you.

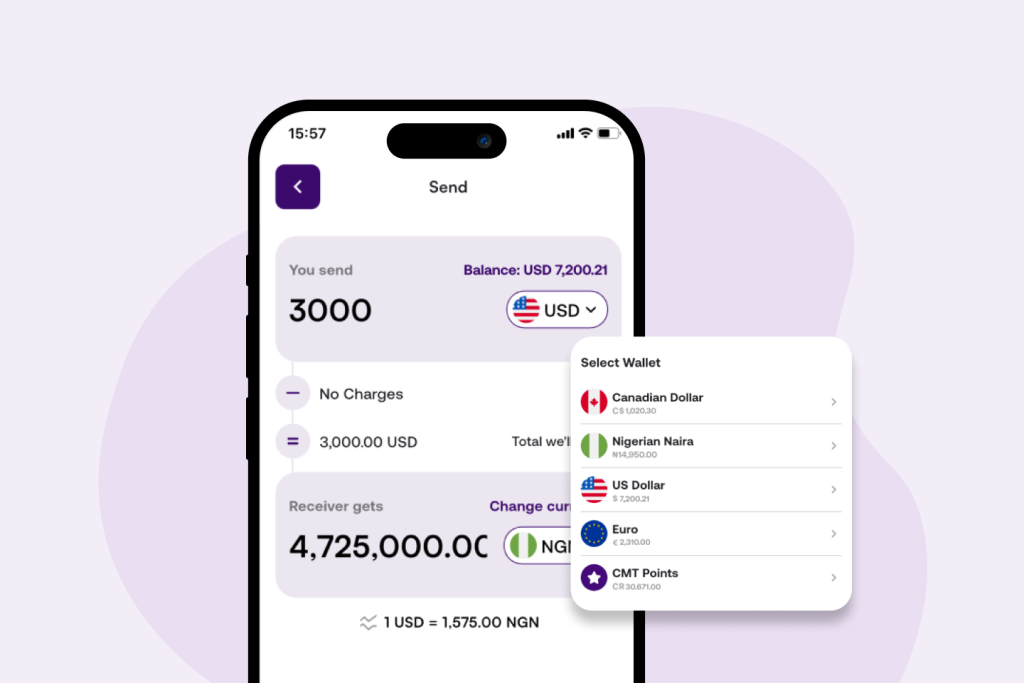

Send & Convert Money with CadRemit Across Multiple Currencies

The CadRemit app supports real-time currency conversions at competitive rates, low fees, and no long wait times. CadRemit supports real-time currency conversions between:

- NGN to CAD, USD, EURO

- USD to CAD, NGN, Euro

- Euro to CAD, USD, NGN.

- CAD to Euro, USD, NGN.

Unlike traditional banks that offer poor FX rates or require multiple steps, CadRemit currency converter shows you exactly what your recipient will get, no hidden fees, and what you see is what you get.

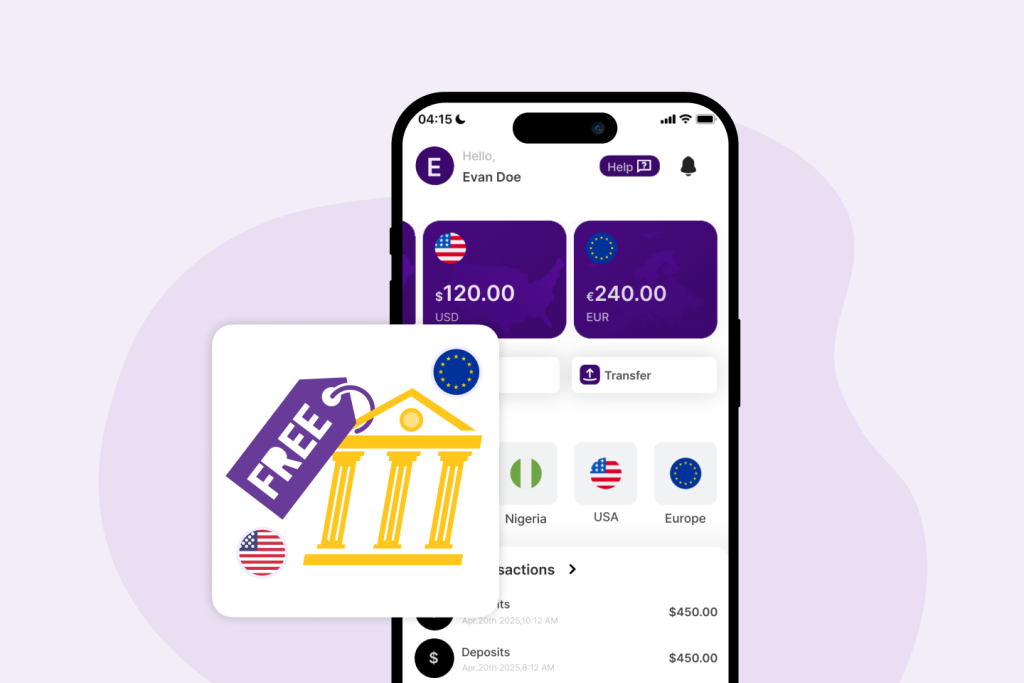

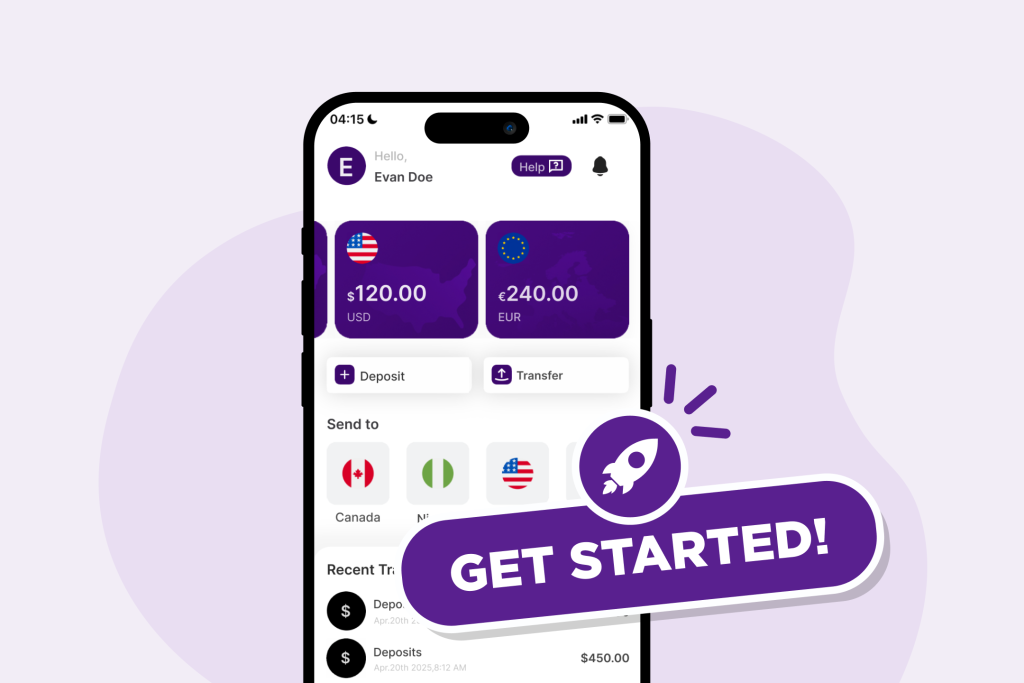

Access to USD & Euro Virtual Accounts

If you’re a freelancer, remote worker, or small business owner in Nigeria, you know how hard it is to get paid in foreign currency. CadRemit offers free USD and Euro virtual accounts to make deposits to these accounts with zero fees, which you can use to:

- Receive payments from global clients or freelance platforms, friends and family, and everyone else.

- Convert the money you’ve received to naira anytime, directly in-app

This allows you to save more and not use expensive intermediary services or black-market rates.

Leading Innovative Money Transfer Options

CadRemit gives you various options to do easier and faster remittance across Nigeria, Canada, Europe, and the United States. Most transactions are completed in minutes, and there is no need for it to take more days than it should. They include the following:

Interac e-Transfer

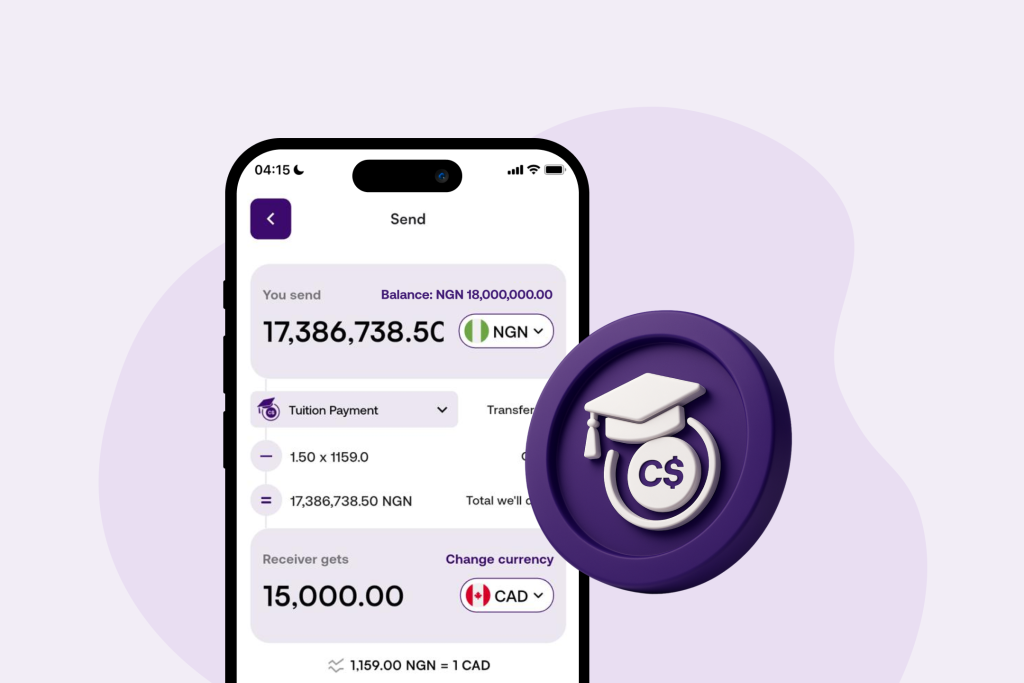

This is a quick and secure way to send money within or to Canada. As a CadRemit user, you can fund your wallet using Interac e-Transfer directly from Canadian bank accounts. It is instant; the money typically arrives within minutes. And the transfer fee for this transfer option is C$1.50.

EFT (Electronic Funds Transfer)

EFT allows direct deposits from Canadian bank accounts into your CadRemit wallet. It’s ideal for larger or scheduled payments, and the money usually arrives within 12–48 business hours. And you use this transfer option for a C$1.50 transaction fee.

SEPA (Single Euro Payments Area)

If you’re making Euro transfers, it is the transfer option that works. SEPA is a quick and low-cost transfer option available to up to 36 European countries. With CadRemit, if you’re in Europe, you can fund your wallet or receive Euro payments instantly using this option.

Push To Card

Push to Card lets you send money directly to a recipient’s Visa or Mastercard debit card linked to a U.S. bank account. Transfers with Push To Card happen within minutes, making it perfect if you’re looking for instant transfers. All you need to add is the recipient’s 16-digit debit card number and expiry date; however, the CVV is not required. Then the transfer is processed via Visa Direct or Mastercard Send and routed directly to the recipient’s bank account via their card.

ACH (Automated Clearing House)

This is a widely used U.S. transfer option for transferring money between banks. CadRemit supports ACH for funding wallets or receiving payments from U.S. accounts, with processing typically in 1–3 business days.

Pay Canadian Tuition from Nigeria — No Third Parties

One of CadRemit’s standout features is helping Nigerians pay school fees directly to Canadian institutions. If you are looking to pay for school abroad? CadRemit has partnered with over 50 Canadian educational institutions, allowing you to:

- Pay directly from Nigeria to the school’s account.

- Get faster confirmations.

- Avoid third-party charges.

You can pay your tuition directly using the Electronic Fund Transfer (EFT) or Interac e-transfer option on the CadRemit app. But first, confirm which of these payment methods your school supports on the app.

To use the EFT payment, you’ll need your school’s bank name, transit number, and account number. And if you’re opting for the Interac e-transfer, you’ll need your school’s email address. Simply add the email address and the amount you want to pay, then confirm your transaction. Remember, you can download the receipt and share it with your school as proof of payment.

Transparent Fees And Best Currency Exchange Rates

Security And Compliance You Can Trust

CadRemit’s commitment to regulatory compliance contributes to helping minimise the risks of delayed transactions and legal complications. CadRemit operates strictly under the guidelines set forth by the Financial Transactions and Report Analysis Centre of Canada (FINTRAC), as an authorized and regulated Money Service Business for foreign exchange and money transfer services. The platform operates under financial regulations in both Nigeria and Canada, allowing users to trust the legality and security of their transactions.CadRemit is registered and regulated in the jurisdictions it operates. It uses bank-level encryption, multi-factor authentication, and follows strict KYC/AML protocols to ensure secure and compliant transfers.

All transactions on CadRemit are:

- Encrypted using bank-grade security protocols.

- Monitored under strict KYC (Know Your Customer) and AML (Anti-Money Laundering) laws.

- Backed by regulatory licenses in the countries where CadRemit operates.

This ensures your money and data stay safe, and every transaction is traceable and compliant.

Earn Points On Your Cross-border Transfers

CadRemit rewards users for every transfer they make from Canada, Europe, or the USA to Nigeria.

Here’s how it works:

- Every transfer you make from Canada, Europe, or the USA to Nigeria earns you points. The more you send in a month, the more points you earn, which you can convert to any of our supported currencies you choose.

- The CMT points you earn can be used in the next month. However, your transactions only count for the month they’re made in, and in a new month, you’ll need to make new transfers to earn more points.

- These points will automatically appear in your CMT wallet.

- You can convert these points to any of our supported currencies you choose and use them to make a transfer on the CadRemit app from your CMT wallet.

This offer is available for all our supported currencies and regions. Please note that terms & conditions apply, and CadRemit reserves the right to modify the offer at any time.

Get Started With CadRemit Today?

- Download the CadRemit app on the Google Play Store or the App Store.

- Sign up using your email.

- Verify your identity with your government-issued ID.

- Fund your wallet with Naira, CAD, USD, or EUR and start sending.

CadRemit’s mobile app design is simple, the steps are clear, and everything from onboarding to completing a transfer. You can:

- Fund your wallet with different transfer options depending on the country.

- View your full transaction history.

- Track real-time exchange rates.

- Complete actions in just a few taps.

Is CadRemit Worth It?

If you’re looking for the best remittance app for Nigerians abroad, CadRemit offers a powerful blend of low fees, instant transfers, and smart tools like virtual accounts. Whether you’re paying tuition, funding your family, or managing freelance income, CadRemit is designed for people like you.